HELOC Masters & Drawbacks

Before you decide whether or not to score a great HELOC, it is vital to weigh the pros and you will drawbacks. Some tips about what to look at.

Advantages of choosing an excellent HELOC

- A beneficial HELOC allows you to basically use what you need on the amount of time you need it

- ?HELOCs will often have down interest levels and better terms and conditions than borrowing notes, but furthermore the independence that accompanies revolving borrowing from the bank

- Having fun with a beneficial HELOC to settle education loan financial obligation get help save you money according to your role

- ?HELOCs is actually a simple way to handle unexpected costs, such as home fixes

- ?You can safe good HELOC today, and after that you are certain to get access to fund later on for many who you need them unconditionally

- You will find income tax great things about HELOCs-such as for example, some of the attract paid off to your a good HELOC can be income tax-allowable provided the money has been used for domestic home improvements otherwise solutions

Disadvantages of employing an excellent HELOC

- ?If you use a beneficial HELOC, you’re using your family since the equity. If you decided to default towards financing, this may indicate dropping your house

- ?HELOCs suggest you’re more likely to accumulate a lot more personal debt than you you prefer

- There is also a sense of suspicion with HELOCs as if the worth of your home alter, you could have a reduction in the level of borrowing from the bank offered to you personally. The financial institution might freeze the newest offered borrowing from the bank entirely

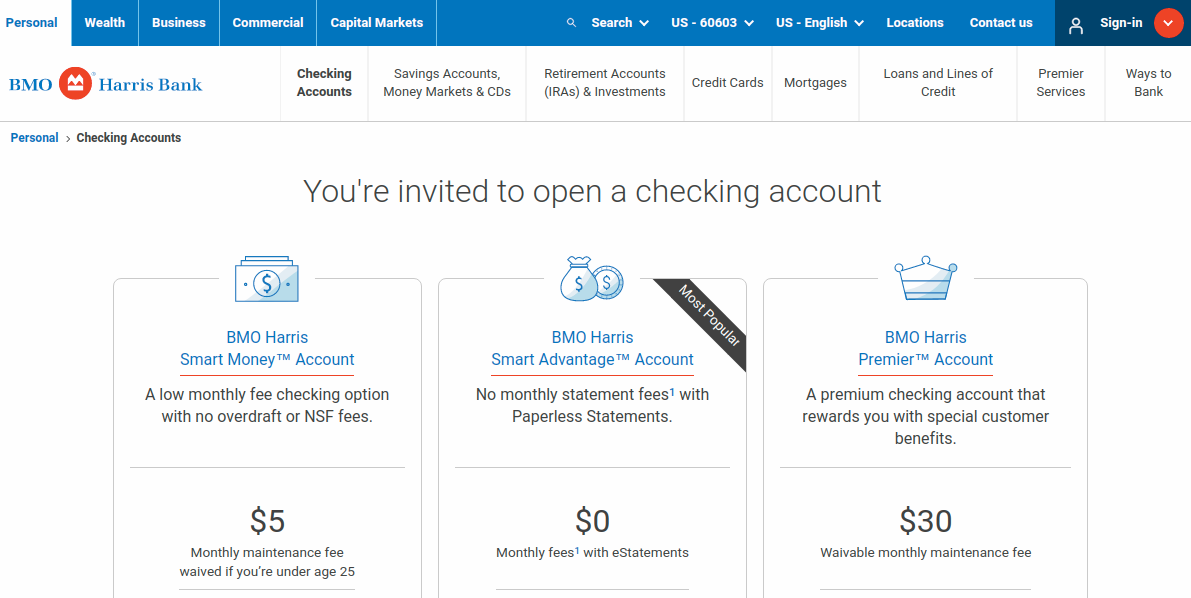

For individuals who consider the huge benefits and you will disadvantages and finally pick an effective HELOC ‘s the right one for you, make sure you evaluate loan providers, because they tend to will vary in what they supply, like with advertising and marketing also provides.

Alternative Money Options to HELOCs

Otherwise want to make use of a personal line of credit, you can even thought most other home equity resource alternatives, such as for example household equity money otherwise house collateral opportunities.

Both possibilities allows you to utilize the collateral you built in your home so you can secure a lump-share payment which can be used but not you want.

Property equity financing is more closely regarding a good HELOC than simply a home collateral financing. Such financing generally incorporate fixed costs and you can fees episodes anywhere between four and you will 30 years. Consumers build fixed monthly installments throughout the installment period to pay off the loan.

Property equity resource, at exactly the same time, is significantly some other. It’s usually for people who are not entitled to traditional home collateral capital. While you are your property commonly however act as guarantee, there are no monthly obligations. As an alternative, property owners discover a lump-contribution commission in exchange for a portion of their household security. The new funding company will share in the prefer otherwise depreciation of your house during the title. Usually, you’re going to be necessary to create you to percentage to settle the brand new capital. This can be done which have bucks, due to home financing refinance, or a house selling.

The latest lender’s HELOC device is called the Meters&T CHOICEquity, and it’s stated since the a loan to help with unexpected expenditures otherwise domestic fixes-although domestic equity money could also be used some other intentions as well.

- Rates: BB&T is now advertising changeable basic prices as low as step three.99% to have half a year . The latest basic speed is actually guaranteed to have 12 months having a primary draw from $15,100000 or higher on closure. When the marketing and advertising speed ends, costs try claimed only 5.24% .

Really HELOC lenders have a tendency to legs the degree of borrowing they provide towards the a certain part of the loan-to-worthy of ratio. The newest fee is commonly from around 80% so you can 90%. In case your lender within specific example would provide a home security personal line of credit for 90% https://paydayloancolorado.net/stonewall-gap/, the fresh resident would next gain access to $180,one hundred thousand. It is ninety% of guarantee he has got in their house.